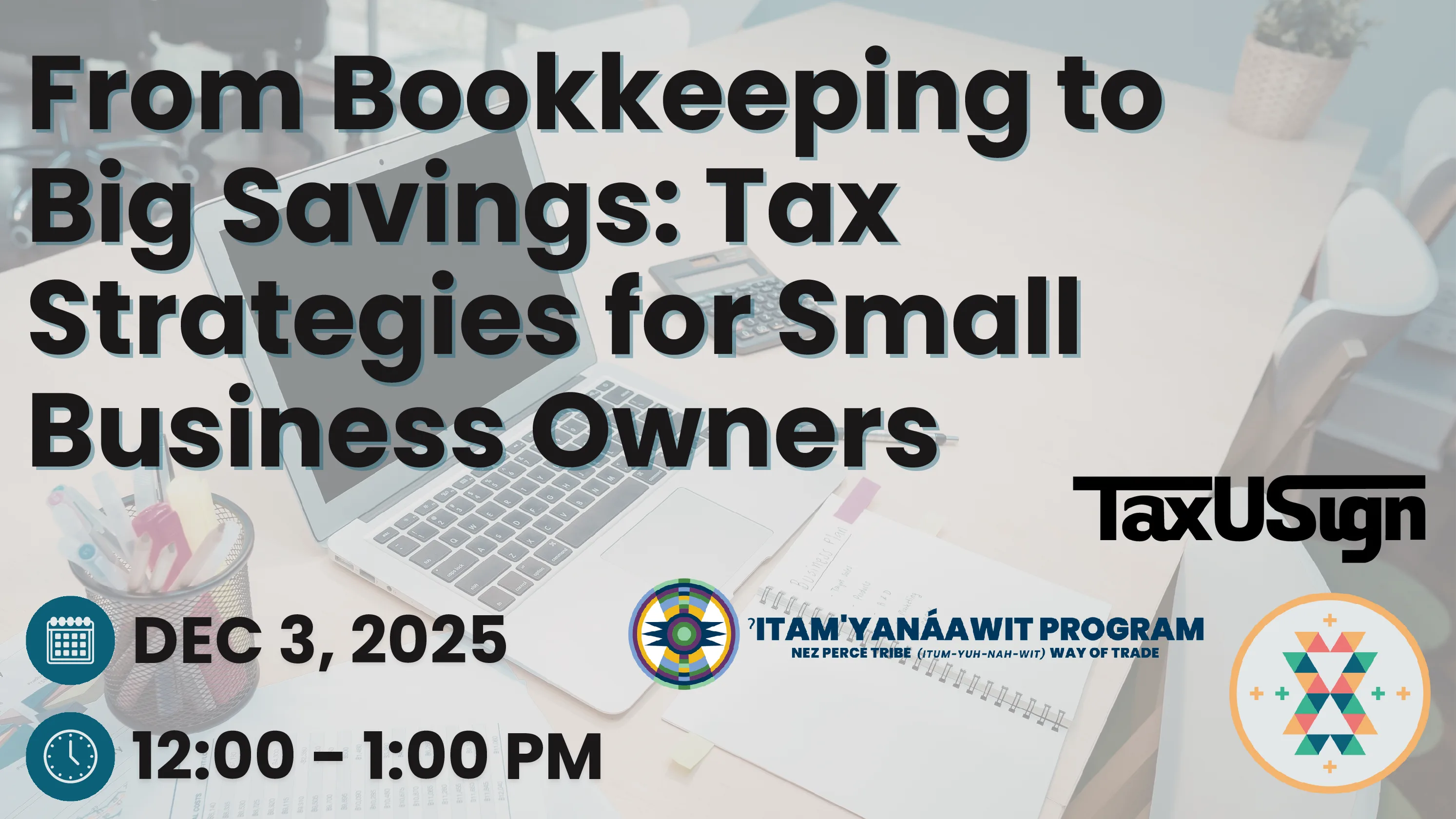

December 3

12:00 – 1:00PM via Zoom

Small business owners face unique challenges—and unique opportunities—when it comes to tax planning and financial strategy. Join us for a powerful one-hour webinar featuring Lily Tran, Enrolled Agent and Founder of TaxUSign®, a Washington-based firm dedicated to helping entrepreneurs and individuals navigate taxes with clarity and confidence. In this session, From Bookkeeping to Big Savings: Tax Strategies for Small Business Owners, Lily will share practical, high-impact tax strategies designed to help you reduce your tax burden, strengthen your business operations, and plan proactively for long-term financial success. Whether you’re a startup, an established business, or preparing for growth, this webinar offers valuable insights you can put to work right away.

Hosted in partnership by the Northwest Native Chamber & the Nimiipuu Tribe’s Itam’yanáawit (Way of Trade) Program.

About the Presenter: Lily Tran

Lily Tran is licensed by the U.S. Treasury Department as an Enrolled Agent, authorized to represent taxpayers before the IRS in audits, collections, and appeals. As a Certified Tax Coach, Certified Tax Planner, and NTPI Fellow, she brings over 15 years of expertise in accounting, tax, advisory, and strategic planning for entrepreneurs, small business owners, and corporations. Lily is a respected educator and sought-after speaker who has been featured in Bloomberg Tax and Accounting and SUCCESS Magazine. She serves her clients through her firm TaxUSign®, offering virtual tax solutions, strategic planning, audit representation, and supportive guidance that leads to measurable tax savings and peace of mind. A recording of this webinar will be edited for participant privacy by Lily and shared via YouTube for all registered participants.